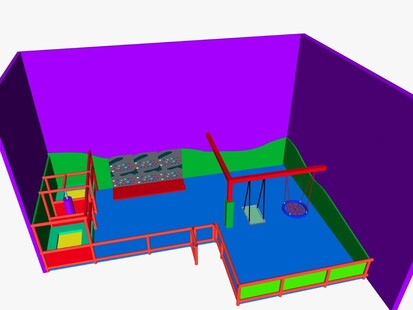

Fundraising for our Sensory Gym

A project such as a Sensory Gym is an expensive project to fund. The cost will be far in excess of our regular running expenses and necessitates extra fundraising to ensure that we get the best and safest equipment for our pupils use.

How people can help us:

- Buy a piece of equipment or share in the cost of a piece of equipment.

- Give a donation of your choice

- Donations over €250 - You get to have a plaque dedicated to your company, your family or a loved one on the Sensory Gym Memorial Wall which will be located on the corridor to the Sensory Gym.

- If your company has a Sports & Social Club, perhaps they could run an event and donate the proceeds to Holy Family School, to be used specifically towards our project.

If you would like any more information about our Sensory Gym, please do not hesitate to contact us. To go ahead with donating towards our Sensory Gym, you can donate via:

- Cheque - addressed to Holy Family School, Baker’s Road, Charleville, Co.Cork.

- Via electronic banking - Contact Joan at 063-81621 for details.

Tax Efficient Giving.

Tax Efficient Giving is the term for when you make a donation to a registered charity like Holy Family School and that charity is able to claim back the tax that you have paid on your donation.

When you donate to Holy Family School, the school could receive more value than the original donated amount when you fill out a simple form called a CHY3 Cert or a CHY4 Cert. These forms can be downloaded here CHY3 Cert or a CHY4 Cert.

How does Tax Efficient Giving Work?

If you are a tax payer and you donate more than €250 in a calendar year to Holy Family School, we can claim tax back on your donation.

Your donation can be in the form of one single gift or it can be an accumulation of donations throughout the year.

This tax back scheme only applies to personal gifts and donations and does not apply to funds raised through sponsorship. Tax Rebates are calculated at a special ‘blended rate’ of 31% which means if you donate €250 to Holy Family School that will get us an extra €112 as a Tax Rebate. This would mean a total of €362 to help fund our school and supports.

Which form should I complete?

CHY3 Form

You should complete an Enduring Certificate if you wish to allow Holy Family School to claim tax relief in respect of donations you make to Holy Family School during the lifetime of the certificate.

An Enduring Certificate is valid for a period of 5 years, unless you cancel it before the end of that period. You should complete this form only in respect of donations for 2016 and subsequent years.

CHY4 Form

You should complete an Annual Certificate if you wish to provide Holy Family School with the necessary information on an annual basis to support a claim for tax relief in respect of your donations to Holy Family School. You should complete this form only in respect of donations for the tax year 2016 and subsequent years.

There are three easy steps to Tax Efficient Giving:

1. Download the CHY3 or the CHY4 form above.

2. Fill out and sign the CHY3 or the CHY4 form.

3. Post to:

Kathryn O Connell

Holy Family School

Bakers Road

Charleville

Co. Cork P56 AH39.

When you donate to Holy Family School, the school could receive more value than the original donated amount when you fill out a simple form called a CHY3 Cert or a CHY4 Cert. These forms can be downloaded here CHY3 Cert or a CHY4 Cert.

How does Tax Efficient Giving Work?

If you are a tax payer and you donate more than €250 in a calendar year to Holy Family School, we can claim tax back on your donation.

Your donation can be in the form of one single gift or it can be an accumulation of donations throughout the year.

This tax back scheme only applies to personal gifts and donations and does not apply to funds raised through sponsorship. Tax Rebates are calculated at a special ‘blended rate’ of 31% which means if you donate €250 to Holy Family School that will get us an extra €112 as a Tax Rebate. This would mean a total of €362 to help fund our school and supports.

Which form should I complete?

CHY3 Form

You should complete an Enduring Certificate if you wish to allow Holy Family School to claim tax relief in respect of donations you make to Holy Family School during the lifetime of the certificate.

An Enduring Certificate is valid for a period of 5 years, unless you cancel it before the end of that period. You should complete this form only in respect of donations for 2016 and subsequent years.

CHY4 Form

You should complete an Annual Certificate if you wish to provide Holy Family School with the necessary information on an annual basis to support a claim for tax relief in respect of your donations to Holy Family School. You should complete this form only in respect of donations for the tax year 2016 and subsequent years.

There are three easy steps to Tax Efficient Giving:

1. Download the CHY3 or the CHY4 form above.

2. Fill out and sign the CHY3 or the CHY4 form.

3. Post to:

Kathryn O Connell

Holy Family School

Bakers Road

Charleville

Co. Cork P56 AH39.